State Retirement Plan Mandate

What States Have Them, Which States Are Pending and When Do They Take Effect?

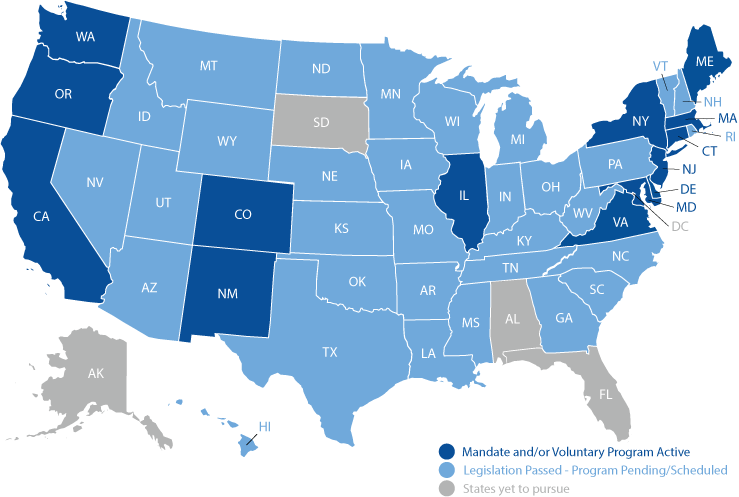

In recent years, states across the country have enacted retirement savings programs to help individuals save for retirement. The rules of these state mandated programs vary greatly from state to state, but they could help bridge the retirement gap for as many as 41 million U.S. workers who currently don’t have access to an employer-sponsored plan. While this is an important step in fully addressing the retirement gap and its effects on the private sector, what does it mean for business owners?

Depending on where the business operates, there are specific retirement plan adoption deadlines that companies will be required to meet to continue operating legally and avoid penalties.

At TRA we want to help close the retirement access gap, we’re incredibly excited by these new developments and the renewed interest in retirement savings. To help you decipher these mandates, we’ve broken them down by state.

Which states have mandatory retirement plans?

-

When states require employers to provide their employees with retirement savings opportunities, it’s known as a state mandated retirement. Businesses generally have two ways to comply with these laws – enroll their employees into a state-sponsored retirement program or sponsor a plan of their own through the private market, such as those offered by TRA.

-

▾

California

CalSavers

- Program: Eligible employers with one to four employees – December 31, 2025

- Status: Active

- Penalties: If the business fails to comply within 90 days from receiving this notification, the state will fine it $250 per employee. After 180 days, the penalty increases by $500 per employee, for a total of $750 per employee.

- Click here for more details to help business owners benefit.

-

▾

Colorado

Colorado Secure Savings Programs

- Program: The Colorado Secure Savings Program requires businesses with five or more employees to offer a workplace retirement program. The state implemented its program and employers can begin registering.

- Status: Active

- Deadline: Registration deadline has already passed. If you missed it, you should register immediately or certify your exemption online.

- Requirements: Companies with 5 or more employees. Has been in business for more than 2 years.

- Penalties: Eligible employers must offer a plan or face up to $100 per eligible employee each year up to $5,000.

- Click here for more details to help business owners benefit.

-

▾

Connecticut

MyCTSavings

- Program: Employers with 5 or more employees and don’t have an existing qualifying retirement plan, are required to provide access to the Connecticut Secure Choice Savings Plan or a private retirement plan. The program will not be mandatory for businesses with fewer than five employees or those that already offer a work-based retirement savings option.

- Status: Active

- Upcoming deadline: The Retirement Security Authority is still refining the implementation timeline and we expect more updates to come.

- Penalties:

- Small employers (5–24 employees): Up to $500

- Medium employers (25–99 employees): Up to $1,000

- Large employers (100+ employees): Up to $1,500

- Penalties start in 2026 following the 2025 law changes.

- Click here for more details to help business owners benefit.

-

▾

Delaware

Delaware EARNS

- Program: The Delaware EARNS state-sponsored retirement plan is set to launch July 1st of 2024.

- Company has 5 or more employees. In business for at least 6 months.

- Doesn’t offer a qualified employer sponsored retirement plan.

- Status: Passed

- Upcoming deadline: Employers have until October 15, 2024, to register or certify that they’re exempt from the EARNS requirement. Employers can be exempt if they offer a qualified retirement plan, have fewer than five employees, or have been in business less than six months.

- Penalties:Eligible employers must offer a plan or face a penalty of $250 per eligible employee per year (up to max of $5,000 annually).

- Program: The Delaware EARNS state-sponsored retirement plan is set to launch July 1st of 2024.

-

▾

Hawaii

Hawaii Retirement Savings Program

- Program: The Hawaii Saves Retirement Program will be a payroll deduction IRA. This means each employer is required to automatically enroll each employee into the program if they do not already sponsor a qualifying plan. Those who are enrolled will automatically have a portion of their salary placed in an IRA. Any employee may opt-out at any time.

Employers must be:

-

- In business for more than two years

- This does not apply to employers who are a part of a state or federal government agency.

Employees must be:

-

- A resident of the state

- At least 18 years old

- Employed and receive wages from an employer

- Status: Expected to be up and running by mid-2026

- Upcoming deadline: The bill passed in May of 2022. The program is expected to be operational by mid-2026

- Penalties: If eligible employees are not automatically enrolled, employers must:

- Deposit the amount that would have been made by the employee into the employee’s account (interest rates apply).

- Pay a penalty of $25 for each month the covered employee was not enrolled in the program and,

- $50 for each month the eligible employee continues to be unenrolled after the penalty has been given.

-

▾

Illinois

Illinois Secure Choice Retirement Program

- Program: Employers with 5+ employees, who have been in operation for at least two years, are required to provide access to the Illinois Secure Choice state retirement program or a qualified retirement plan by November 1, 2023. Exempt employers include those with fewer than 5 employees, have been in business for less than two years, or who already offer an employer-sponsored retirement plan.

- Status: Active

- Upcoming deadline: All deadlines have passed.

- Penalties: Businesses with 25+ employees may face $250 per eligible employee for the first calendar year. An additional $500 per employee for each subsequent calendar of non-compliance.

- Click here for more details to help business owners benefit.

-

▾

Louisiana

- Program: Introduced Senate Bill 283 which would have established the Louisiana Retirement Savings Plan for employers who do not provide their employees with access to a retirement plan. No further legislative action was taken after it was referred to the Committee on Retirement.

- Status: Pending

- Upcoming deadline: TBD

-

▾

Maine

Maine Retirement Savings Program

- Program: The Maine Saves Retirement Program, under the bill, private-sector workers would contribute to a Roth IRA from their paychecks. The bill will require employers to provide employees the choice to contribute to a payroll deduction Roth IRA by automatically enrolling them with an opportunity to opt out. Covered employees that do choose to opt out will be automatically re-enrolled with the opportunity to opt out again at regular or ad hoc intervals. Latest expecations are that employers may voluntarily offer the program to its employees in late 2023. Additionally, employers with five or fewer employees are not required to offer the program, they may choose to do so.

- Status: Expected to be up and running by late 2023

- Upcoming deadline: June 30th 2024 (5-14 employees) –

- Deadline for 15+ employees was April 30th 2024

- Penalties: New penalties go into effect July 1st 2025.

- $20 per covered employee from July 1, 2025, to July 30, 2026

- $50 per covered employee from July 1, 2026, to July 30, 2027

- $100 per covered employee on or after July 1, 2027

- The final deadline for organizations to comply will be December 31st, 2024 with fines starting in 2025.

- Click here for more details to help business owners benefit.

-

▾

Maryland

Maryland $aves

- Program: Maryland’s new Automatic Retirement Savings Plan, MarylandSaves automatic retirement savings program allows an employer to provide its workers with access to a payroll-deducted savings program if they are not eligible to participate in an existing employer plan. The State will waive the $300 annual report filing fee every year an employer participates in the State program or offers a qualified plan for their employees.

- Status: Active

- Upcoming deadline: The state will contact the businesses that meet the criteria and give them a deadline.

- Incentive: Employers who register and participate in Maryland$aves receive a $300 annual waiver of the Maryland business filing fee (SDAT annual report fee).

- Incentive: Every year that a business is enrolled, the Maryland Department of Assessment and Taxation will waive its $300 annual report filing fee.

- Penalties: At this time, there are no penalties if an employer does not offer MarylandSaves or another retirement plan.

- Click here for more details to help business owners benefit.

-

▾

Massachusetts

CORE Plan

- Program: Nonprofit organizations with 20 or fewer employees must offer a retirement benefits plan through a 401(k) multiple employer plan (MEP) through the Massachusetts Defined Contribution CORE Plan or a private provider. Participants must have payroll administered by an eligible third party.

- Status: Active

-

▾

Minnesota

Minnesota Establishes State-Sponsored ‘Secure Choice’

- Program: All Minnesota employers with five or more employees that do not currently sponsor a retirement plan will be required to participate. Eligible employees will contribute a portion of their pay into IRAs (individual retirement accounts). The default retirement account will be a Roth IRA (i.e., contributions will be made after taxes), unless the covered employee elects to contribute on a pretax basis.

- Status: The statute is immediately effective, but the obligations of employers will not be operative until the program is fully established, which looks to be January 1, 2026.

- Upcoming deadlines:

Number of employees at covered employer Phase duration Soft launch for any sized covered employer Jan. 1, 2026 to March 30, 2026 100 or more April 1, 2026 to June 30, 2026 50 to 99 July 1, 2026 to Dec. 31, 2026 25 to 49 Jan. 1, 2027 to June 30, 2027 10 to 24 July 1, 2027 to Dec. 31, 2027 5 to 9 Jan. 1, 2028 to June 30, 2028 - Penalties for Non-Compliance:

- $100 per employee after two years of non-compliance

- $200 per employee in the third year

- $300 per employee in the fourth year

- $500 per employee each year after the fourth

- If an employer fails both to enroll employees and distribute required information, penalties are doubled.

- Employers who fail to remit payroll deductions for retirement contributions within 10 days after demand may face misdemeanor charges.

- Click here for more details to help business owners benefit.

-

▾

Missouri

Show-Me Retirement Savings Plan

- Program: Pending the governor’s signature, the Show-Me MyRetirement Savings Plan is a voluntary Open MEP for businesses with 50 or fewer employees. It is scheduled to launch Sept. 1, 2025, and employers (for-profit and non-profit) that have not had a plan within the past two years would be eligible to participate. Employees 18 years of age and old receiving wages in Missouri would be eligible and be automatically enrolled. There is the ability for employees to opt out, as well.

- Status: Active with provisions currently operating or scheduled to be implemented in the coming years.

- Penalties: $250/employee for the first violation. $500/employee for the second violation. $1,000/employee for the third and subsequent violations.

-

▾

Nevada

Nevada Employee Savings Trust (NEST)

- Program: The NEST program officially launched in June 2025, with a compliance deadline of September 1, 2025. The state may roll out implementation in phases based on employer size, but all eligible employers must act by the deadline.

- Status: This automatic enrollment payroll deduction IRA is expected to be operational July 1, 2025.

- Employers affected: Participation is mandatory for businesses that:

- Have six or more employees in Nevada,

- Have been in operation for at least 36 months, and

- Do not offer a tax-qualified retirement plan (e.g., 401(k), 403(b), SIMPLE IRA, or SEP)

- Penalties: The law states that employers who fail to comply may be subject to penalties, but Nevada has not yet published the penalty structure.

- Click here for more details to help business owners benefit.

-

▾

New Jersey

RetireReady NJ

- Program: Both non- and for-profit businesses with 25 or more employees that have been in business for at least two years must implement the RetireReady New Jersey Program or provide access to a qualified retirement plan. Smaller or newer employers can join voluntarily.

- Status: Active

- Deadline: All deadlines have passed.

- Penalties:

- Year 1: Written warning

- Year 2: $100 per employee

- Years 3–4: $250 per employee

- Year 5 and beyond: $500 per employee

- Click here for more details to help business owners benefit.

-

▾

New Mexico

NM Work and Save IRA, NM Retirement Plan Marketplace

- Program: On February 26, 2021, Gov. Michelle Lujan Grisham signed the New Mexico Work and Save Act, creating a voluntary Roth IRA savings option for workers without employer-based retirement accounts, plus an online marketplace (the Retirement Savings Plan Marketplace) of private-sector providers for employers.

- Status: The most recent target was July 1, 2024, but as of late 2025, the program is still not active and details are being finalized.

- Deadline: Registration deadlines have not been set, and participation remains voluntary for both employers and employees.

- Penalties: No penalties exist at this time.

- Since the program is voluntary and not yet implemented, there are no fines or enforcement provisions for employers who do not participate.

-

▾

New York

New York Secure Choice

- Program: On October 21, 2021, Governor Hochul signed into law The New York State Secure Choice Savings Plan program, requiring all private employers who have employed at least 10 New York-based employees during the previous calendar year, and that have been in business for at least 2 years, to enroll their employees in the State program, or offer a qualified retirement plan. The State program follows a Roth IRA structure.

- Status: Active with provisions currently operating or scheduled to be implemented in the coming years.

- Penalties: $250/employee for the first violation. $500/employee for the second violation. $1,000/employee for the third and subsequent violations.

- Click here for more details to help business owners benefit.

-

▾

Oregon

OregonSaves

- Program: All employers with employees in Oregon must offer a qualified retirement plan to their employees or implement OregonSaves.

- Status: Active

- Upcoming deadline: All deadlines have passed.

- If you start a business in Oregon:

- January 1 – March 31: Register by July 31 of the same year

- After March 31: Register by July 31 of the following year

- If you start a business in Oregon:

- Penalties: $100 per eligible employee, up to $5,000 a year.

- Click here for more details to help business owners benefit.

-

▾

Vermont

VTSaves

- Program: The VT Saves program establishes a retirement savings plan for Vermonters who are not currently offered a retirement plan through their employer. It’s designed to make saving for retirement easy and automatic, at no cost to employers and no ongoing cost to taxpayers.

- Status: Pending. The VTSaves VT Saves will take effect in 2025.

- Upcoming deadline:

- July 1, 2025 (25+ employees), January 1, 2026 (15-24 employees),

- July 1, 2026 (5-14 employees)

- Penalties:

- Prior to October 1, 2025: Maximum penalty is $10 per covered employee.

- October 1, 2025 to September 30, 2026: Maximum penalty is $20 per employee.

- After October 1, 2026: Maximum penalty is $75 per employee.

-

▾

Virginia

RetirePath Virginia

- Program: In 2021, the Virginia General Assembly passed legislation directing Virginia529 to establish a state-facilitated private retirement savings program to open in 2023. The program will require employers who have been in business for at least 2 years with 25 or more employees to implement the state program or offer a qualified retirement plan.

- Status: Active

- Penalties: $200 per eligible employee annually.

- Deadline: September 18, 2023 – Early Registration Closed. February 15, 2024 – Employer Registration Deadline.

- Click here for more details to help business owners benefit.

-

▾

Washington

Washington Saves

- Program: The Washington State Legislature created the Small Business Retirement Marketplace to provide small businesses and individuals access to a retirement plan. Covered employers are any businesses located in the state of Washington in business for at least two years, whose employees worked a combined 10,400 hours the previous calendar year, and do not currently offer a workplace retirement plan. Employers must enroll any employee who has worked for one continuous year or more at the business.

- Upcoming deadline: This program is anticipated to launch on January 1st 2027.

- Status: Participation is mandatory unless employers already offer a qualified retirement plan.

- Penalties: For violations occurring after Jan. 1, 2030, the maximum penalty for a first-time willful violation is $100 and $250 for the second willful violation. The maximum penalty for each subsequent violation is $500.

- Click here for more details to help business owners benefit.

-

Alternative TRA Solutions to Consider

For businesses who want to sponsor a retirement plan, some plans to consider include:

• 401(k)

• Safe Harbor 401(k)

• Cross Tested Profit-Sharing Allocation

• 401(k) plus Cash Balance Plan

Other alternatives to state retirement plan mandates include SIMPLE 401(k) Plans, Group 401(k) Plans (MEPs, PEPs and Aggregation Programs), and 403(b) Plans (for non-profits).

Working closely with you, TRA will create a customized plan that meets your client’s business. We partner with top recordkeepers and investment managers around the country and deliver exceptional client service. We also offer 3(16) Fiduciary Services to relieve business owners of day-to-day plan administration responsibilities and manage their fiduciary risk.

Complete the form below and a Regional Plan Consultant will be in contact with you.