By Jenny Kiffmeyer, J.D – The Retirement Learning Center

“At least weekly, I see a headline about pension plan ‘de-risking.’ Generally, I don’t deal directly with pension plans. Can pension de-risking impact my practice and, if so, what are its potential effects?”

Highlights of Discussion

Pension plan de-risking can have a material impact on your practice, even if you do not advise on defined benefit (DB) plans, especially with respect to lump sum rollovers. In a nutshell, pension de-risking consists of a series of forward-thinking, plan design strategies engineered to help reduce volatility with respect to a business’s DB pension plan obligations and corporate balance sheet.

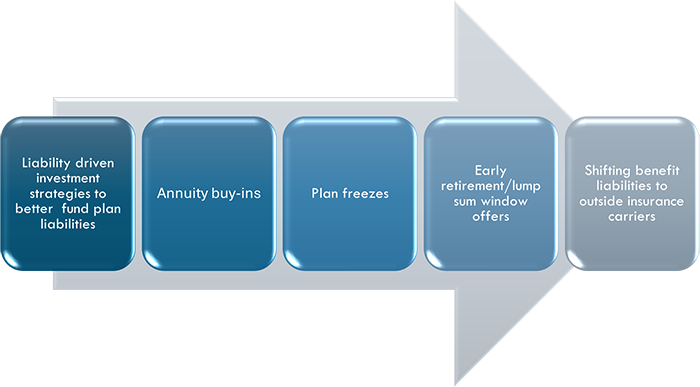

Pension plan sponsors must meet funding requirements and any shortfalls are reflected on their corporate balance sheets. They are under tremendous pressure to reduce the financial liabilities of their DB plans. Consequently, more and more are turning to de-risking strategies. The following graphic illustrates the continuum of de-risking strategies that companies typically use. According to October Three, Plan sponsors often state that rising overhead expenses, especially rising Pension Benefit Guaranty Corporation (PBGC) premiums, are a key driver for the decision to de-risk. Plan sponsors also indicate that inflation, market volatility, rising interest rates, and an increase in the volume of term vested and retired participants are reasons for initiating a pension risk transfer (PRT) to insurance companies through annuity buyouts.

According to October Three, Plan sponsors often state that rising overhead expenses, especially rising Pension Benefit Guaranty Corporation (PBGC) premiums, are a key driver for the decision to de-risk. Plan sponsors also indicate that inflation, market volatility, rising interest rates, and an increase in the volume of term vested and retired participants are reasons for initiating a pension risk transfer (PRT) to insurance companies through annuity buyouts.

Many plan sponsors consider a combination of a lump sum offer and annuity buyout strategy for derisking their plan. Lump sum offers and annuity purchases are not an all-or-nothing decision. For example, a plan sponsor can purchase annuities for a subset of the plan’s retiree population. Annuity purchases for retirees with relatively small plan benefits can be a very efficient way of reducing PBGC premiums. Verizon and Shell U.S.A. Inc., have transferred $5.9 billion and $4.9 billion respectively in pension liabilities this year, with both utilizing a partial retiree buyout strategy.

Conclusion

The financial climate is right for the pension plan de-risking trend to accelerate. Whether a financial advisor works directly with DB plans or not, he or she can realize opportunities to speak to clients about the effects of pension de-risking. Monthly updates on the annuity purchase marketplace can be found here.