Payroll & Retirement Integration Made Easy

-

PRIME can provide an easy, safe, and cost-competitive solution without incurring additional administrative burdens.

PRIME can provide an easy, safe, and cost-competitive solution without incurring additional administrative burdens.-

▾

What is PRIME?

PRIME stands for Payroll and Retirement Integration Made Easy. It’s a Group 401(k) program designed and made available for an organization’s members or clients.

-

▾

Who Can Benefit From PRIME?

Any group with access to clients or members can become an endorser. An endorser does not assume the liabilities or responsibilities that named fiduciaries have for endorsing the plan.

-

▾

What Benefit Does PRIME Provide?

Allows members or clients ability to transfer fiduciary responsibilities and liabilities with positive impact on expenses through aggregation scale.

-

▾

Speak With A PRIME Consultant

Complete the form below and a PRIME Consultant will be in contact with you.

-

▾

PRIME Video

-

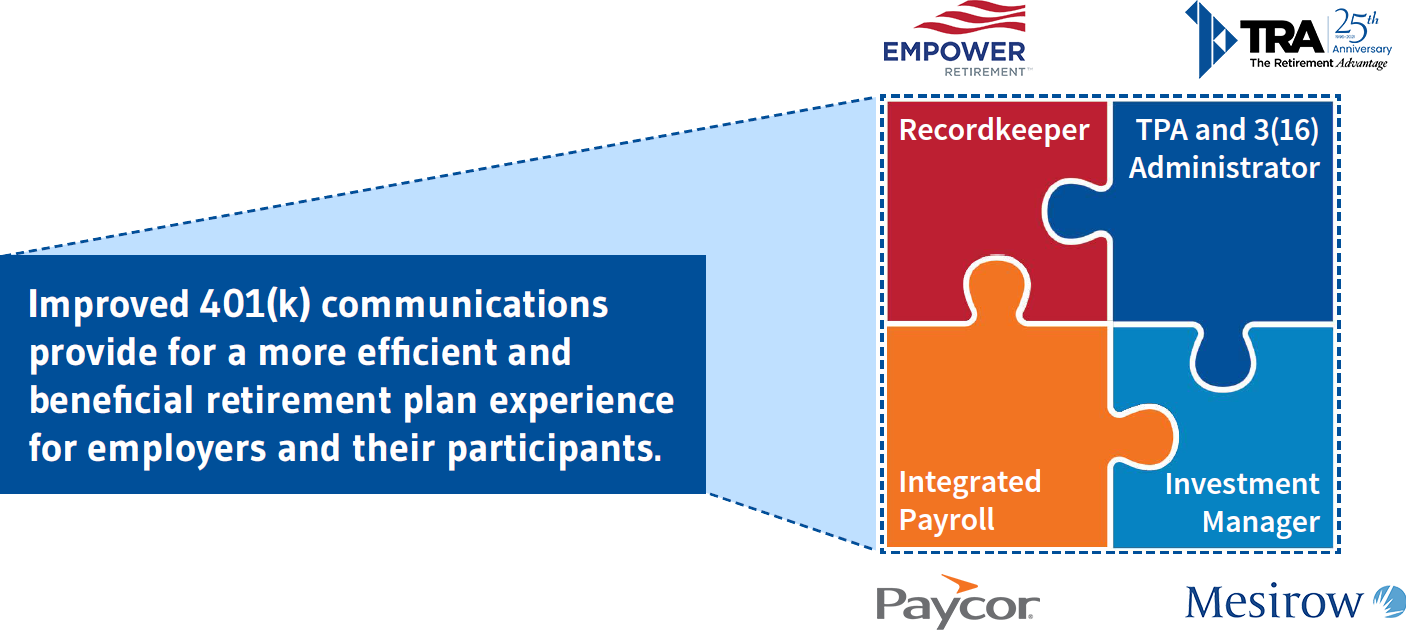

It’s all about simplicity.

-

PRIME powered by Paycor, provides clients with peace of mind by offering a seamless payroll and retirement integration between Empower Retirement and Paycor while transferring fiduciary responsibility with a managed investment lineup by Mesirow and 3(16) plan administration by TRA.

PRIME powered by Paycor, provides clients with peace of mind by offering a seamless payroll and retirement integration between Empower Retirement and Paycor while transferring fiduciary responsibility with a managed investment lineup by Mesirow and 3(16) plan administration by TRA. PRIME helps employers:

PRIME helps employers:- Seamless payroll and retirement integration with easy access to data

- Increased efficiencies with timely funding of retirement plan

- Reduced errors by eliminating manual processes

- Robust, customizable 401(k) census reporting

- Managed investment portfolio 3(38)

- 3(16) Plan Administration

Audit Services

-

▾

Let PRIME complete your retirement puzzle

Why Join Prime?

-

Single Employer Plan VS. PRIME

-

▾

Your Responsibilities as a Plan Sponsor BEFORE joining PRIME

- Identify and track all eligible participants

- Your plan document must be written to comply with all requirements in the Internal Revenue Code.

- Your plan must be administered to follow its terms in operation.

- Review your plan annually to make sure it’s operating according to its terms and the law.

- Review the plan document for law changes and update it as necessary.

- Enforce the plan’s terms for participation, contributions and distributions.

- Give the required plan notices to the participants.

- File required forms and documents with the IRS or Department of Labor.

- Determine any required testing and timely conduct it.

- Maintain records for participant accounts.

- Invest the plan funds and determine any associated fees.

- Learn about your fiduciary responsibilities.

- Bring the plan back into compliance (if it becomes non-compliant) and pay any fees associated with this process.

- Review your service provider’s reports

- Determine participant eligibility

- Oversee year end census data and remit to TPA

Review and validate the compliance testing - Address participant related requests or information related to fee disclosure requirements compliance under section 404(c) of ERISA

- Administer participant loans in compliance with statutory requirements

- Administer distribution and rollover request for terminated employees

-

▾

Your Responsibilities as an Adopting Employer AFTER Joining PRIME

- Select a customized plan design options to meet your businesses needs

- Prudently select a retirement plan to adopt and offer to your employees

- Review annual census data to ensure accuracy*

*If you are using a payroll company, these duties may already be performed for you

-

Partners

Organization |

(Details about Client Firm / Organization / Endorser) |

|

|---|---|---|

| Recordkeeping Services: |  |

At Empower Retirement our mission is simple: We want to help people build a better financial future. Serving more than 12 million participants across 67,000 organizations, our innovative approach to retirement savings has proven to get results.*

We empower retirement savers by making the journey more personalized and less intimidating. We empower organizations with simplified administration and dependable service. And our partnership with Great West Investments allows us to offer unique investment options for people at any life stage. |

| 3(38) Inv Fiduciary |  |

Mesirow is a pioneer and industry leader of plan-level 3(38) fiduciary services. |

| TPA Administration & 3(16) Services: |  |

Premier third-party administrator (TPA) that specializes in administration, consultation and compliance of retirement plans for businesses nationwide. When you partner with TRA, you gain a trusted retirement plan expert. |

| Payroll Integration |  |

A complete Human Capital Management suite of software to modernize every aspect of people management, from the way you recruit, on-board, and develop people to the way you pay and retain them. |

| Financial Advisor | The financial advisor plays a key role in helping you with the due diligence process and documentation of that process. In addition, many offer services that help increase participation, help with enrollment meetings, provide investment guidance and education, provide regular plan reviews, and suggest potential plan enhancements. |

SAMPLE PLAN LINEUP

![]()

REQUEST FOR PROPOSAL

Complete the form below and a PRIME Consultant will be in contact with you.

Upcoming PRIME Events

-

-

▾

More Coming Soon

-

Past PRIME Events

- 9/14/21 – Happy Hour – Atlanta, Georgia

- 10/25/21 – Disrupt HR – Orlando, Florida

- 10/25/21 – Happy Hour – Colorado Springs, Colorado

- 10/27/21 – Wine Tasting – Fort Lauderdale, Florida

- 12/9/22 – TopGolf – Schaumburg, Illinois

- 3/17/22 – TopGolf

- Edison, North Carolina

- Germantown, Maryland

- Auburn Hills, Michigan

- The Colony, Texas

- Houston, Texas

- 6/8/22 – PRIME Webinar – (Watch Recorded Webinar Today)

Interested in having a PRIME event in your area?

Contact our PRIME specialist at 833.872.4015 Ext. 3210 and we will be in contact with you.

PRIME can provide an easy, safe, and cost-competitive solution without incurring additional administrative burdens.

PRIME can provide an easy, safe, and cost-competitive solution without incurring additional administrative burdens.