By Jenny Kiffmeyer, J.D – The Retirement Learning Center

Sources of Retirement Income

ERISA consultants at the Retirement Learning Center (RLC) Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings and income plans, including nonqualified plans, stock options, and Social Security and Medicare. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

A recent call with a financial advisor from Alabama is representative of a common inquiry related to retirement income. The advisor asked: “I’ve been talking to my clients about sources of retirement income. On average, what are the most prevalent sources of income for a retiree and what percentage does each represent?”

Highlights of the Discussion

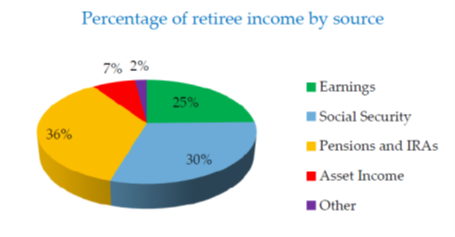

No longer do we have the old “three-legged stool” of retirement income, which consisted of Social Security, private pensions and personal savings. A 2021 study by the Social Security Administration revealed that the average retiree’s income comes from workplace retirement plans (primarily defined contribution plans) and IRAs (36%), followed by Social Security benefits (30%) and earnings from work (25%).

Source: Social Security Administration, Improving the Measurement of Retirement Income of the Aged Population, 2021

The DOL’s requirement for plan sponsors to provide retirement income illustrations to participants with defined contribution plans will push the issue of retirement income even more. A key differentiator for advisors, moving forward, will be the ability to effectively support participants in transitioning away from a lump sum accumulation mindset to a true retirement income focus.

Conclusion

Nowadays, the primary sources of retirement income come from a person’s defined contribution plans and IRAs, Social Security benefits and workplace earnings. How to convert retirement plan and IRA balances into a reliable stream of retirement income is the next critical issue that needs innovative solutions.