By Jenny Kiffmeyer, J.D – The Retirement Learning Center

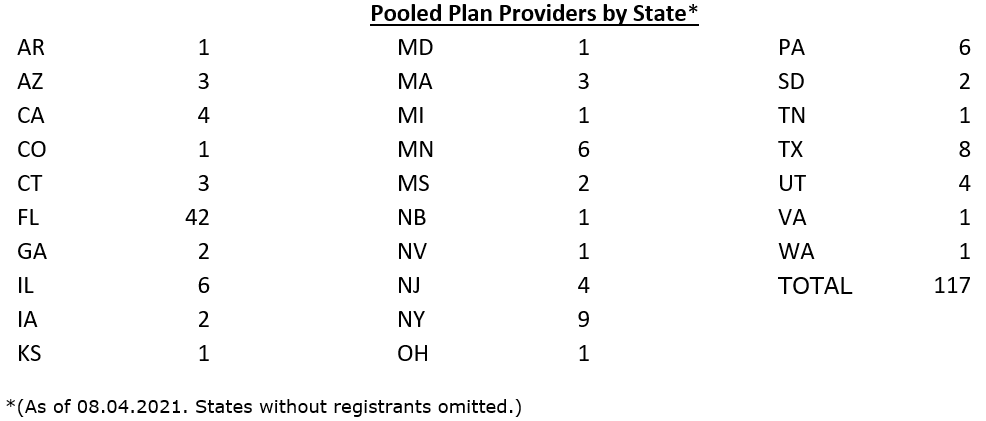

Pooled Plan Providers to Date by State

ERISA consultants at the Retirement Learning Center (RLC) Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings and income plans, including nonqualified plans, stock options, and Social Security and Medicare. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

A recent call with a financial advisor from Colorado is representative of a common inquiry related to Pooled Plan Providers. The advisor asked: “Do you have any statistics around how many Pooled Plan Providers (PPPs) have registered with the Department of Labor (DOL), and where they are located?”

Highlights of the Discussion

Yes, we do have some statistics based on a tool on the DOL’s website that shows PPP filings. As of August 3, 2021, the number of PPP’s that have registered with the DOL to be able to offer Pooled Employer Plans (PEPs) is 117. Keep in mind that number will continue to change. Registering with the IRS and DOL is one of the requirements for a firm to become a PPP of a PEP. Below is a summary of the number of PPPs by state.

The most likely entities to serve as PPPs include financial institutions, such as banks and insurance companies, record keepers, large broker/dealers, registered investment advisor firms, payroll providers and local chambers of commerce.

To encourage more businesses to sponsor workplace retirement plans, Congress created PEPs, available for adoption starting in 2021 through registered PPPs. PEPs are new plan structures created by a segment of the Further Consolidated Appropriations Act of 2020 also known as the Setting Every Community Up for Retirement Enhancement (SECURE) Act. These new plan arrangements allow two or more completely unrelated employers to participate in a single retirement plan administered through a registered PPP. Each employer has the fiduciary duty to prudently select and monitor the PPP and other fiduciaries of the PEP.

Conclusion

PEPs became available for adoption starting in 2021 through registered PPPs. Thanks to a tool on the DOL’s website, the industry can stay up to date on PPP registrants.