By Jenny Kiffmeyer, J.D – The Retirement Learning Center

ERISA Fidelity Bond Failure—So what?

ERISA consultants at the Retirement Learning Center (RLC) Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings and income plans, including nonqualified plans, stock options, and Social Security and Medicare. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

A recent call with an advisor in Texas is representative of a common question related to the Department of Labor’s (DOL’s) requirement for retirement plans to have ERISA fidelity bonds. The advisor asked: “I’m aware of a business retirement plan that has not maintained an ERISA fidelity bond for the plan for the last several years. What penalties is the plan facing?”

Highlights of Discussion

Through examinations of Forms 5500, the IRS has determined that one of the top two most common compliance issues among plans is not having adequate ERISA fidelity bond coverage. The DOL, pursuant to ERISA Sec. 412 and related regulations, generally requires every fiduciary of an employee benefit plan and every person who handles funds or other property of a plan be bonded to protect the plans from risk of loss due to fraud or dishonesty on the part of the bonded individuals. Please see the Department of Labor’s Field Assistance Bulletin 2008-04 for more details on ERISA Fidelity Bonds. The DOL also has a handy hand-out entitled Protect Your Employee Benefit Plan with An ERISA Fidelity Bond that provides an overview of the bonding requirements and how to obtain a bond.

Although the DOL imposes an ERISA fidelity bonding requirement on employee benefit plans,[1] the agency has not identified a specific penalty for failing to have an appropriate bond when one is required. In practice, plan officials who have failed to secure bonds have received a range of consequences from auditors’ admonitions to obtain the necessary bonds to court mandates for their removal as plan fiduciaries and plan termination.

There are substantial risks associated with not meeting ERISA’s bonding requirements:

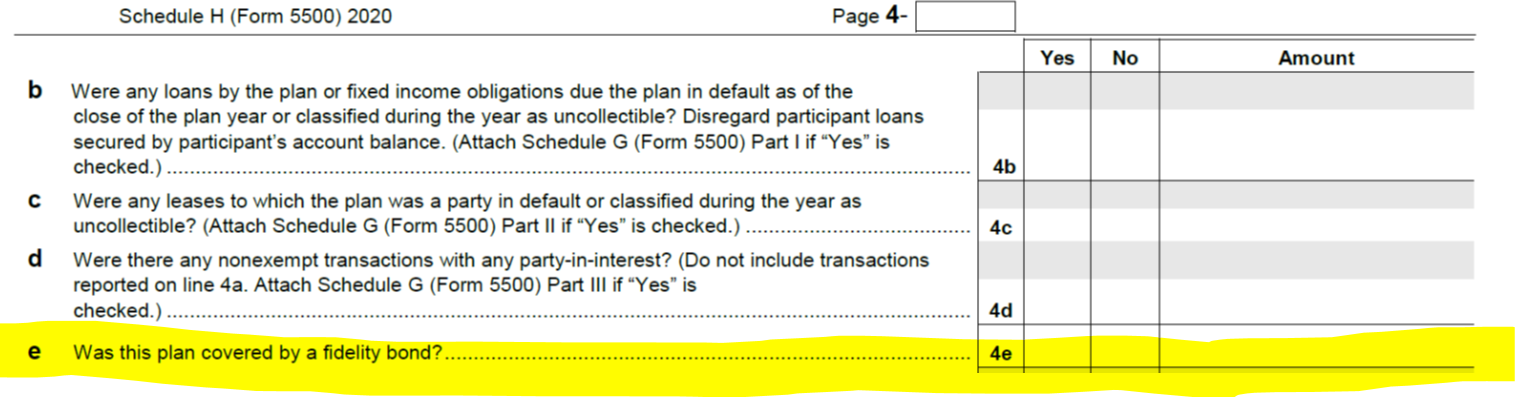

- Failing to report a sufficient bond on the Form 5500 can trigger a plan audit.

- It is against ERISA law for plan officials to be without an ERISA bond.

- Plan fiduciaries can be held personally liable for losses that could have been covered by a fidelity bond.

Consider the following court case.

In Chao v. Thomas E. Snyder and Snyder Farm Supply Inc. 401(k) Plan, Civil Action No. 1:00CV 889, a federal district court judge in Grand Rapids, MI, ordered the defendant (the owner of a company) to purchase and maintain a fidelity bond for the company’s 401(k) plan until the latter was terminated. The defendant also was ordered to direct the plan’s custodian to distribute or roll over the accounts of plan participants. Under the consent judgment and order obtained by the DOL, Snyder, who was a fiduciary of the 401(k) plan, further agreed to pay all expenses related to the distributions, rollovers, or plan termination, except for annual maintenance fees charged against each plan participant’s account.

Conclusion

Although no particular DOL penalty is evident for failing to have an ERISA fidelity bond when one is required, nonetheless, noncompliant plan officials must be aware they expose themselves, unnecessarily, to DOL audits, personal liability and potential lawsuits.

[1] Exceptions: The bonding requirements do not apply to employee benefit plans that are 1) completely unfunded or that are not subject to Title I of ERISA, or 2) maintained by certain banks, insurance companies and registered broker dealers.