Solo(k) Cash Balance Plans

-

While there are a number of retirement plan options for owner-only businesses, few options are as robust as a Solo Cash Balance Plan. These types of plans are ideal for business owners (with no employees), looking to maximize their savings, and have the desire to contribute over and above what a 401(k) Plan can offer.

-

▾

What is a Solo Cash Balance Plan?

A Solo Cash Balance (CB) Plan is an attractive retirement plan option for older business owners with no employees. A Solo CB can be implemented as a stand-alone retirement plan or combined with a 401(k) Plan. A Solo CB is a defined benefit plan, so there is a required contribution, but the plan allows for substantial pre-tax retirement plan contributions, especially for business owners age 50 and older.

-

▾

How do I know if this is the right type of plan for me?

• You wish to contribute over $50,000 per year into a retirement plan.

• You have the intent to make higher retirement plan contributions for 3 years or more.

• Your business has only you or you and your spouse.

Cash Balance plans work with any form of business, incorporated or sole proprietor. So, if the above statements are true, let’s take a closer look into a Solo Cash Balance Plan! -

▾

What are the benefits?

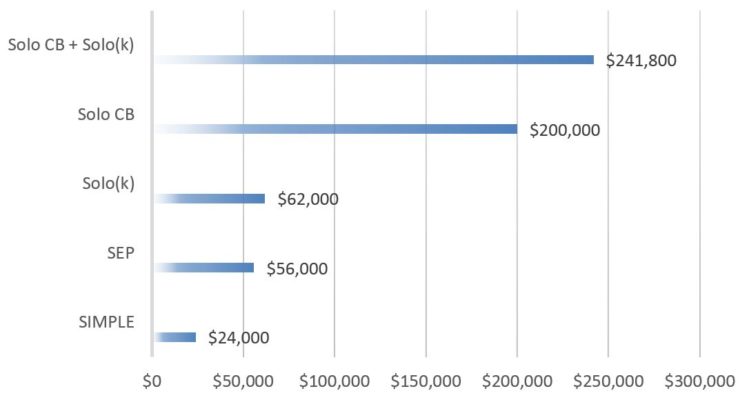

Like any Cash Balance Plan, a Solo CB Plan can help an individual save a substantial amount for retirement over other types of qualified plans. Take a look at this example – a 55-year-old with over $500,000 available for compensation and retirement contributions can save over $200,000 more with a cash balance plan paired with a 401(k) plan, over a SIMPLE IRA.

With a 40% incremental tax rate, the 55-year-old business owner would defer almost $100,000 in taxes annually. At retirement, the benefits both of a Cash Balance Plan and 401(k) Plan can be rolled into an IRA.

-

▾

How do the numbers work?

Here is an example of what an individual can save in a Cash Balance Plan, based on age and their considered earnings. Figures are approximate.

Considered Earnings

Age $280,000 $200,000 $150,000 40 $90,000 $90,000 $90,000 50 $150,000 $150,000 $150,000 60 $280,000 $250,000 $195,000 70 $280,000 $200,000 $150,000 As you can see, these numbers, when also paired with 401(k) deferrals and profit sharing contributions, are substantial!

-

▾

How do I get started?

The first step to take would be to contact your Regional Sales Consultant, as they will be able to discuss details and go over your unique situation. We will then collect census information (compensation, date of birth, date of hire) so we can then create a complimentary individualized plan design and proposal. The design will be reviewed by an actuary before presented. Along with your financial advisor, our Regional Sales Consultants can participate in conference calls or in-person meetings to ensure this is the right type of plan for you.

-